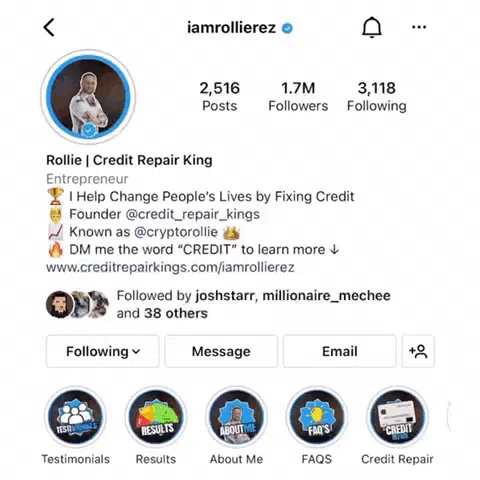

We Can Help You Get Approved For A Mortgage, Car And High-Limit Credit Cards!

🎉 We Can Help You Get Approved For A Mortgage, Car And High-Limit Credit Cards!

What Makes Us Unique?

What Makes

CRK Unique?

We Specialize In Disputing

Inaccurate & Erroneous Info

We Charge A Flat Rate

We Have The Most Aggressive &

Quickest Credit Cleaning Strategy

We Send You Monthly Updates

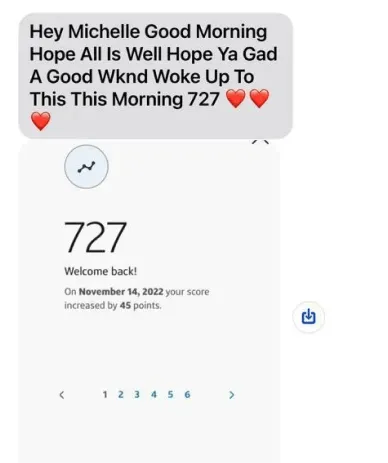

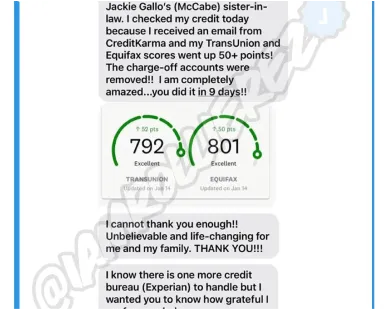

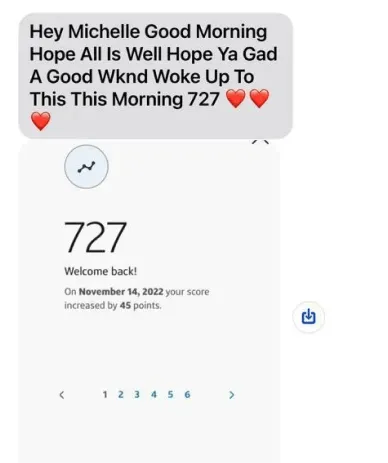

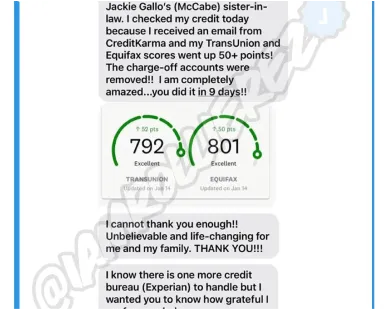

Our Clients Have Seen Results

In As Little As 30 - 45 Days!

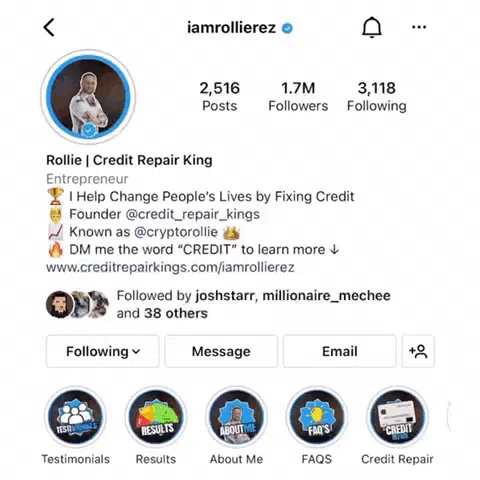

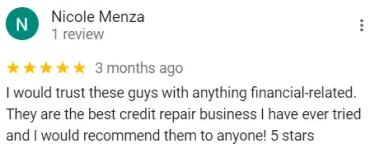

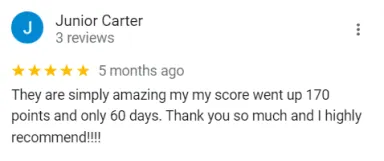

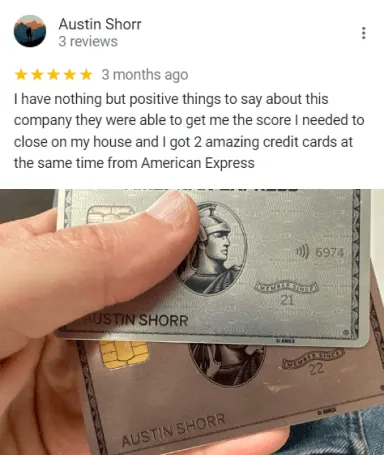

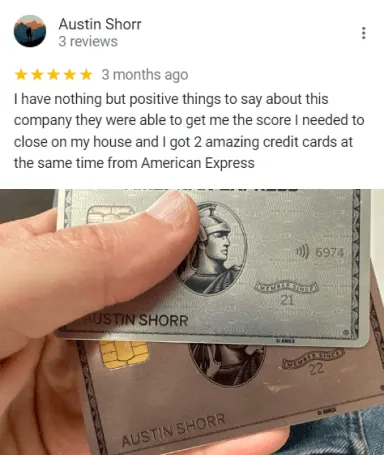

What our customers are saying

"Deciding to go solar was one of the best decisions I ever made"

Our customers don't just like us, they love us!

And we love them!

See what it's like to work with a company that ACTUALLY cares about you and your needs.

WATCH THE VIDEO

Is this 30 minute credit repair

consultation call for me?🤔

Is this 30 minute credit repair consultation call for me?🤔

Yes, this call is for you, especially if you...

Are sick and tired of living with bad credit and not seeing your credit score go up

You've tried fixing your credit in the past and saw no results

Tired of paying monthly fees to credit companies that lack communication

Want to improve your credit so you can finally get approved for your dream house or get the capital you need to start or scale your business

Want a done-for-you credit repair team who will work on your credit every month until your inaccurate negative accounts are removed from your credit report

Are looking to buy a house within 6 - 12 months and need a score boost

If this sounds too good to be true, then we personally invite you to book a credit consultation below and we'll prove it to you.

Don’t Let Bad Credit Keep You From Buying Your

Dream Home!

Don’t Let Bad Credit Keep You From Buying Your Dream Home!

We can help you become approval ready within 6-12 months and can help connect you a mortgage broker that will get you APPROVED for your dream home!

We can help you become approval ready within 6-12 months and can get you a mortgage broker that will get you APPROVED for your dream home!

Plus 1,000 more clients...

THIS IS YOUR

DEFINING MOMENT!

Become A Part of The Credit Repair Kings Family! 🙂

We offer a 100% money back guarantee if you do not see any type of results within 120 days of starting the "Credit Repair Kings Express Program".

What Happens If You Join Our express Program And We Can't Help? 😢

We offer a 100% money back guarantee if you do not see any type of results within 120 days of starting the "Credit Repair Kings Express Program".

© 2023 Credit Repair Kings

All Rights Reserved | Privacy Policy

Disclaimer:

This site is not a part of the Facebook website or Facebook Inc.

Additionally, This site is NOT endorsed by Facebook in any way.

FACEBOOK is a trademark of FACEBOOK, Inc.

Credit Repair Results Disclaimer:

Results may vary and testimonials are not claimed to represent typical results.

We do not claim you will receive a 700 credit score, nor do we make a guarantee.

*Our 120 day money back guarantee is only if we see no type of deletions of negative items such as inquiries, collections, charged offs, etc. within the first 120 days of start date.

All testimonials are real. These results are meant as a showcase of the best credit repair results we have done & should not be taken as average or typical results.

You should perform your own due diligence & use your own best judgment prior

to making any investment decision pertaining to your credit.

By virtue of visiting this site or interacting with any portion of this site, you agree

that you’re fully responsible for the investments you make & any outcomes that may result.